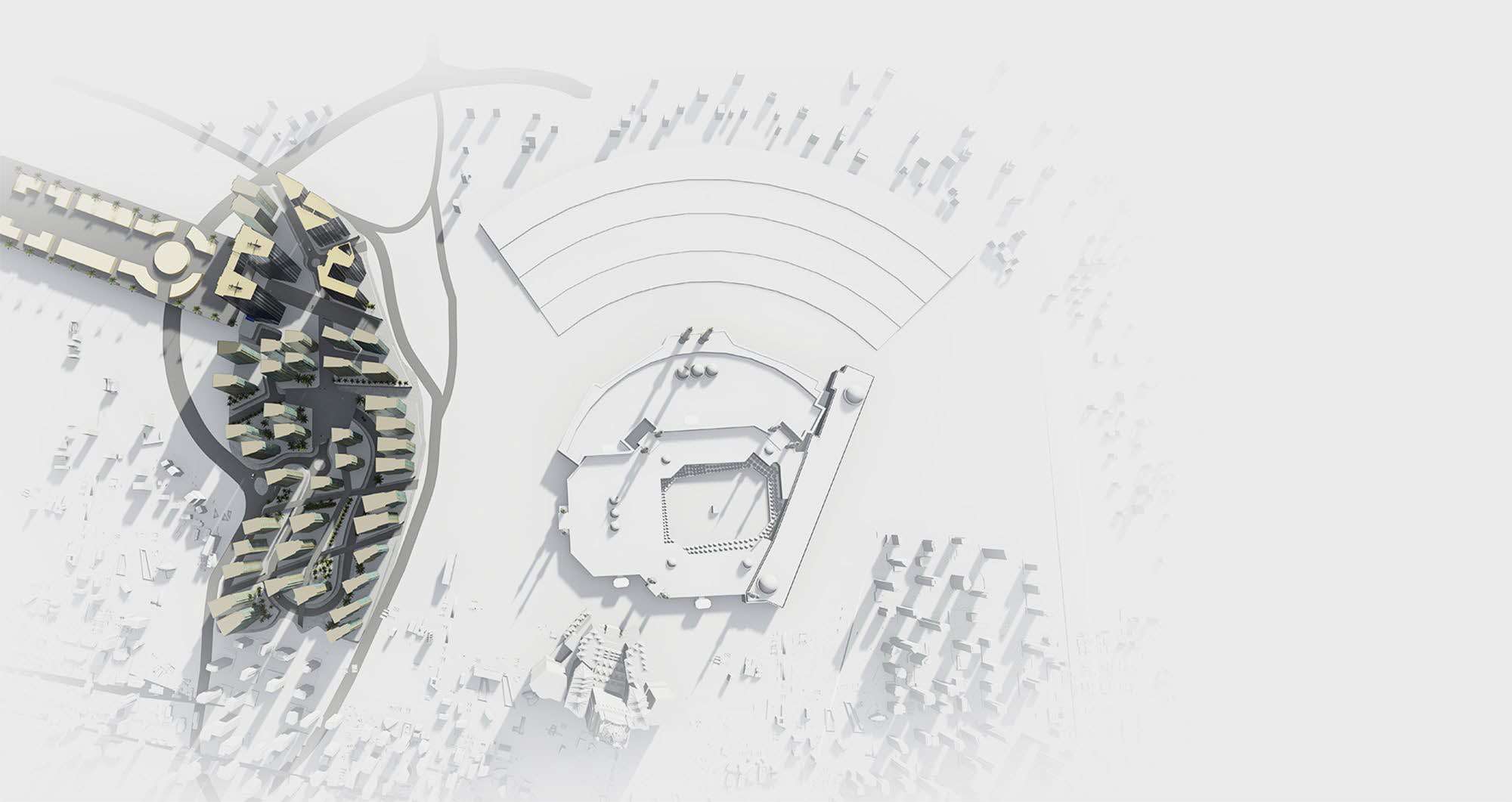

جبل عمر يُجسد الأصالة والحداثة

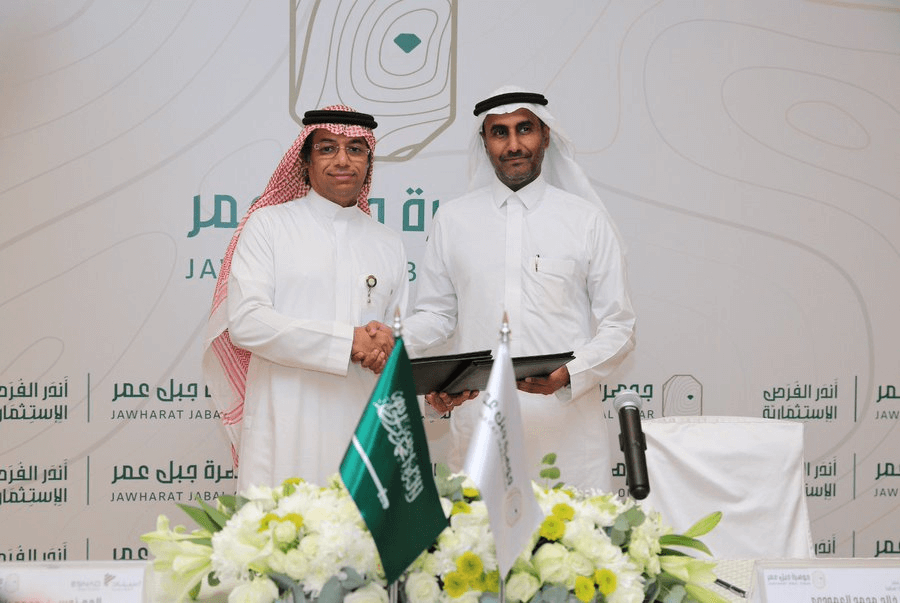

شركة جبل عمر للتطوير الشركة الرائدة في مجال التطوير العقاري في الشرق الأوسط، وتصنف من بين أكبر الشركات المدرجة في سوق الأسهم السعودي، تلعب دورًا محوريًا في مشروع عقاري واسع النطاق متعدد الاستخدامات بفضل موقعها الاستراتيجي بالقرب من المسجد الحرام، كما تشكّل دوراً حاسمًا في المشهد الحضاري في المنطقة بفضل خبرتها التي وحدت ما بين الجودة العالمية والمحلية.

لماذا جبل عمر

تتميز شركة جبل عمر للتطوير بمجموعة شاملة ومتكاملة من الخدمات في مجال التطوير العقاري، مما يجعلها الخيار الأمثل للعديد من الاستثمارات والمشاريع في المملكة العربية السعودية.

000

000

برج

000

000

فندق عالمي

000

000

أسواق تجارية

000

000

مواقف سيارات

تحديث المشروع

أسواق جبل عمر

سوق الخليل 1

قراءة المزيد

سوق الخليل 2

قراءة المزيد

سوق الخليل 3

قراءة المزيد

سوق بوابة مكة

قراءة المزيد

جوائز جبل عمر

سجل شركة جبل عمر للتطوير يمتلئ اليوم بالجوائز العالمية والإقليمية والمحلية، لتثبت هذه الجوائز النجاح الباهر الذي حققته الشركة